Getting Paid Is Fundamental - Accounts Receivable 101

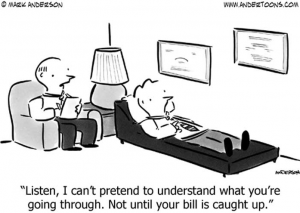

| | Does your accounting practice struggle to get paid promptly? Do you have to threaten clients to pay up before working on their file or before filing their tax returns?

According to a recent study from Accounting Today, the average accounting firm gets paid 30-45 days after the bill is sent out and after services have been provided. As a result, the accounts receivable balance is often a burden to small accounting firms and when some of these balances never get paid, it can become ugly.

One would think that getting paid promptly would be a fundamental skill set that all accountants have and that crossing your fingers and waiting for checks to arrive in the mailbox would be a thing of the past.

To help accountants get paid much faster and get more control over accounts receivable, BYF has created a new payment processing portal that shrinks the payment gap from an average of 30-45 days to less than 5 business days on average. The resulting impact on cash flow is immediate and the uncollectible write-offs drop like a rock.

Learn why this new payment processing tool is receiving rave reviews from accounting firms.