True Costs of Traditional Paper Based Invoicing - Off the Charts

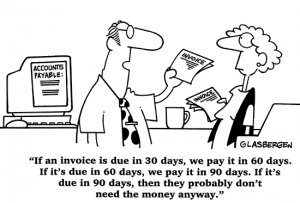

| | The days of "old fashioned" paper based invoicing is off the charts. However, many accounting firms still invoice traditionally and cross their fingers for the check to arrive. And to make this even worse, many are extremely apprehensive to pick up the phone and call those clients for payment and continue to wait for the check to arrive.

the check to arrive. And to make this even worse, many are extremely apprehensive to pick up the phone and call those clients for payment and continue to wait for the check to arrive.

The reality is that most small businesses make a habit of paying slowly and live off the float. And because most accounting firms bill after services are performed and have very little on retainer, this creates and ongoing cash crunch. And, it means more write-offs. Ouch....

According to a variety of studies, here is what the "true cost" of paper based billing really costs you.

True Average Cost

Source

$3.00-$5.00 Institute of Management and Administration

$4.84-$20.13 Aberdeen Group

$4.00 - $20 Bank of America

$7.99 Hackett

Regardless of the study, we all know that the old fashioned way of billing and waiting for the check to arrive is broken and does not work. In fact, that's why nearly every single employee gets paid by direct deposit for payroll. Getting paid electronically is cheaper, faster and so much more reliable.

Let's assume that the cost of waiting for the check to arrive system costs $4.00 per (fully loaded) bill. Then why are so many savvy accountants still processing accounts receivable this way? It does not make business sense.

According to my research, Build Your Firm's BizPayO Payment Processing portal can lower the variable cost to less than $.75 per transaction for electronic processing (ACH and credit cards combined). While this is not fully loaded because there are too many overhead variables, it is over 80% less. And, it gets the accountant paid over thirty (30) days faster. Wow, cheaper, faster and lower write-offs. Hhmmm...

Based on a research study by Accounting Today, the lag time between when an invoice is sent out and when fees are collected is:

When Invoices Are Paid To Accountants% Period of Time

65% Less than 30 days

15% 31-45 days

10% 46-60 days

5% 61-90 days

5% Over 90 days

Source - Accounting Today Executive Research Council, July 2013

If you'd like to get control of AR and lower your costs by 80%, then call Build Your Firm about BizPayO Payment Processing. It's easier than you think.